基金業(yè)務(wù)板塊

The Fund Business

新三板基金業(yè)務(wù)

發(fā)揮在股權(quán)投資領(lǐng)域的多年經(jīng)驗(yàn),以價(jià)值發(fā)現(xiàn)和價(jià)值創(chuàng)造為出發(fā)點(diǎn),依托國泰君安證券在新三板市場掛牌、做市、轉(zhuǎn)板服務(wù)的領(lǐng)先優(yōu)勢,專注投資擬于或已于新三板市場掛牌的高成長性企業(yè),并為所投資企業(yè)提供綜合金融服務(wù),協(xié)助其提升自身市場價(jià)值。

Fund in NEEQ(National Equities Exchange and Quotations)

GIMC has oriented in equity investment for many years and has developed our specialty in valuation. With the leading edge of Guotai Junan Securities in listing, market making and board transferring, GIMC is committed to high growth enterprises which will list/listed in NEEQ. We will provide our invested enterprises with comprehensive financial supports and boost their market value.

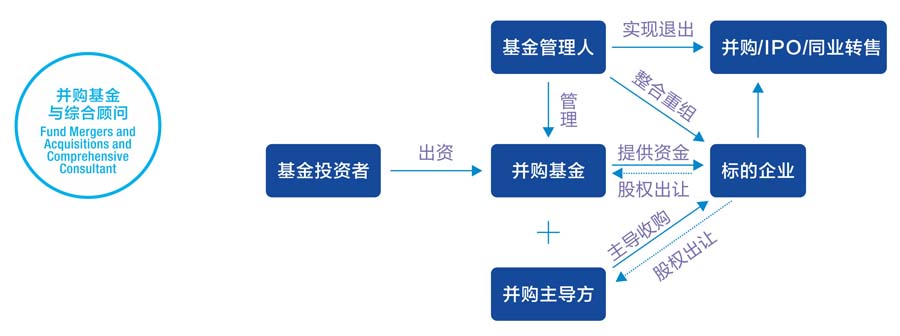

并購基金業(yè)務(wù)

基于行業(yè)知識(shí)、投資經(jīng)驗(yàn)與資源整合等方面的綜合優(yōu)勢,通過發(fā)起設(shè)立并購基金或控股型投資等方式推進(jìn)行業(yè)兼并收購,協(xié)助企業(yè)開展跨地區(qū)、跨所有制的兼并重組,幫助企業(yè)延伸產(chǎn)業(yè)鏈、實(shí)現(xiàn)資源與經(jīng)營的優(yōu)化整合。并通過安排多樣化的退出方式,為基金投資人實(shí)現(xiàn)投資收益。

同時(shí),我們的并購團(tuán)隊(duì)還為希望通過市場與行業(yè)整合及多元化發(fā)展的公司(買方)及希望進(jìn)行價(jià)值提升及產(chǎn)業(yè)擴(kuò)張的公司(賣方)提供行業(yè)研究、盡職調(diào)查、交易結(jié)構(gòu)設(shè)計(jì)等咨詢顧問服務(wù),并可依托國泰君安證券遍布全國營業(yè)網(wǎng)點(diǎn)為客戶尋找的合作伙伴及潛在投資者以實(shí)現(xiàn)交易。

M&A fund

With our specialty in industry knowledge, investment and resource integration, GIMC will provide our client company with optimal solution in trans regional M&A, trans ownership M&A, industry chain optimization . We are well-experienced and could arrange the transaction in the form of M&A fund or share-holding investment, etc. Also, for the best benefit of our client investors, GIMC has developed diversified exit arrangement.

Besides, our M&A Team is always ready to support our clients with the finest industry investment, due diligence investigation, transaction structure design; our branch network is at your service to match the best investor and business partners.